Who is investing in the defense sector? How are US military companies dealing with lagging far behind the private sector in research and technology development? We invite you to read the second part of the interview with Paweł Fleischer, Business Development Manager at TTMS.

Marcin Kapuściński: In recent years, the development of cutting-edge technology by the military has stagnated. The traditional military-industrial ecosystem, where defense major contractors such as Raytheon and Lockheed Martin spend years developing a new fighter or carrier, is not working well with many emerging technologies. In the coming years, can we expect closer ties between government organizations and the technology industry or, for example, restructuring of institutions and a change in the rules of their operation, which would allow for more efficient creation of innovations on our own?

Paweł Fleischer: The modern industrial and defense complex, which includes both governmental and state institutions, as well as private research and development centers and enterprises, has strongly evolved since the 90s. When, as a result of the end of the rivalry between the two superpowers, there were drastic cuts in defense budgets, the process of consolidation of defense industries and the phasing out of certain plants began. Currently, the industrial and defense complex includes not only institutes / enterprises strictly involved in the production of armaments, but enterprises with products / services that may be used in the field of defense. For several years, we have been observing the problems of defense companies in adapting their production and R&D works to the challenges posed by the international environment, and thus in terms of implementing innovative products for military use.

Do these problems – in the US, Europe or China – result from a lack of innovation?

No, they arise more from the problem of acquiring, implementing and applying innovative products or services in the field of defense. Larger platforms are particularly affected by this problem. An example is the programs implemented for the US Air Force in last decades. In the case of the F-16 aircraft, which were developed in the 1970s, 5 years elapsed from the start of deliveries to the moment of obtaining operational capacity. However, in the case of the fifth generation F-35 aircraft, operational capability was achieved after 21 years. It is difficult to compare the two aircraft platforms with each other, but it should be noted that the Chinese fifth generation aircraft development program – the J-20 project – achieved operational capability within 6 years.

Where does the difference in the time of development and commissioning of both aircraft come from?

Certainly, on the American side, it resulted from the complexity of the entire project, the need to introduce new software and the involvement of partners from eight allied countries, or problems with allocation and budget management. Thus, the very process of developing and acquiring weapons has become difficult. On the other hand, China, implementing the project on its own, is better able to allocate its resources, achieving faster results. This important problem is perfectly illustrated by the comedy Pentagon Wars, which shows how the Bradley reconnaissance combat vehicle has been developed for over two decades as a result of the ever-changing requirements of the Pentagon.

Is the Department of Defense aware of the fact, that US defense companies – Raytheon, Lockheed Martin, and Northrop Grumman – are lagging far behind the private sector in research and technology development?

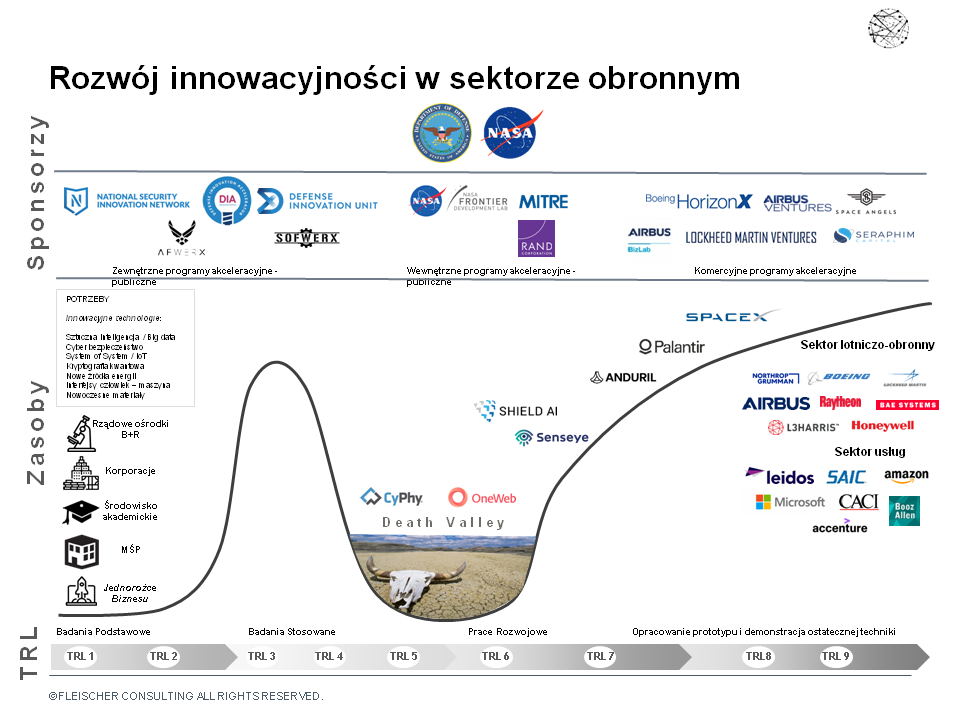

Yes, for example in the field of expenses. Pentagon spent $ 30 billion in 2019, Amazon spent $ 28.8 billion, and Alphabet $ 26 billion on research and development. Lockheed Martin, Raytheon, and Northrop Grumman’s research spending fluctuated around $ 0.6 billion to $ 1.2 billion in the same period. To partially offset the relative decline in R&D spending, the Pentagon created new organizations such as the Defense Innovation Unit (DIU) and the Defense Innovation Board to support the process of accelerating the adoption of private sector technology. DIU is a Pentagon-led spin-on technology search program that connects the military with private sector companies. In addition, for many years, work has been carried out on improving the procurement process and acquiring modern technologies in terms of law and regulation.

The length of the contracting process is probably also important?

In the case of the above-mentioned initiatives, most often, the contract for a prototype solution to an identified problem is signed within 60-90 days, while the traditional contracting process at the Pentagon often takes over 18 months. Prototype projects typically take between 12 and 24 months. The military receives a solution to its problem in a very short time. It should be noted that the issues mentioned above relate to small to medium sized projects / programs and not to large defense programs.

In the Department of Defense, there is a problem of harmonization of work between the work carried out independently by enterprises and the priority directions of defense research, e.g. on quantum research or biotechnology. It turns out that 62% of research projects conducted by enterprises do not meet the needs of the Pentagon. The situation is made more difficult by the fact that most acceleration projects aimed at producing modern technology are not properly monitored. After acceleration, the dissemination of projects to stakeholders is often limited. Most often, a given cell or unit receives information about the developed technology directly from the company during conferences or industrial days. It should also be remembered that the US armed forces have 1.2 million soldiers and over 700,000 civilian employees. This determines the scale of the need for innovation, which not only concerns the arms and military equipment itself, but also the provision of IT systems for managing such an extensive structure, providing infrastructure and transport, and supplying energy. Thus, it is very difficult to reach out with information about an innovative solution in such an extensive system.

In recent years, venture capitals established by defense companies support SMEs in the development of innovative services and products. Can it be called a trend?

Venture capitals are starting to play an important role in the defense and space sectors. This is due to the fact that projects implemented in these areas carry a high risk of failure. Only adequate financing at each stage of product and service development can ensure the success of the venture and achievement of success. VC enable small entrepreneurs to obtain appropriate capital, enabling not only product development, but also the possibility of undertaking a market “fight” with larger players. We have been observing a similar trend for several years in the United States and Western Europe on the defense and space market. Large corporations operating in the defense and aviation sector, such as Raytheon, BAE Systems, Airbus, establish their VCs, but also defense ministries and their subordinate institutions, especially in the USA.

Are private Venture Capitals also interested in investments in the defense sector?

Much less, due to the longer waiting time for return on investment. As for the mentioned example of VC created by the government administration, the US Department of Defense started supporting start-ups and indirectly private VCs towards investments in modern technologies in the early 1980s. Thanks to funds from the US federal budget, companies such as Microsoft and Compaq were established. The US government in the 1980s. spent more than $ 1.35 billion on emerging technologies that still provide Americans with a global technological advantage. In fact, VCs are behind the successes (or failures) of companies such as Amazon, Google, PayPal and Uber. They continue to support and will support innovative companies.

Is foreign capital also visible on the American defense market?

In addition to the existence of American VC, there are funds from other countries, such as China, which also invested money in modern technologies in various markets, including the American one, trying to hit dual-use technologies that could be used in the Middle Kingdom. In order to avoid the hostile takeover of the developed technologies, the Americans created the Trusted Capital Digital Marketplace at the beginning of this year, bringing together trusted VCs or Private Equity funds that will be able to provide financing to small and medium-sized enterprises developing products / services related to security and defense. Focusing on the example of the VC created by the Pentagon, one should mention AFWerx (subordinate to the Air Force) in Silicon Valley. The task of this VC is to support small businesses or start-ups in participating in defense procurement for the Pentagon. Participation in projects implemented for defense ministries is often labor-intensive and requires meeting many formal requirements, for example having an industrial security certificate. Additionally, the ordering process for defense ministries is much longer than for the civil market. AFWerx is designed to help guide small businesses through this difficult stage so that they receive their long-term Pentagon contract at the end of the road. As of 2018, AFWerx has spent $ 710 million on small business contracts to reduce the risk of long waiting times for investment returns. Thus, such entities, thanks to the support of AFWerx and private investment funds, are more interested in participating in defense projects.

It is hard to imagine the arms sector today without Venture Capitals.

Rather, they are one of the financial tools under development that can support the activities of small and medium-sized enterprises in the defense market. On the other hand, when referring directly to defense companies, it should be noted that the VCs created are to help in obtaining the desired technology from the civil market faster than could be produced by the concern’s laboratories. They most often target niche technologies or those related to software development. This is due to the simple fact that a software company can provide a relatively greater and faster return on investment than, for example, a startup dealing with “innovative technology”, such us protections for ship or aircraft shells. This trend is also related to the defense industry’s entry into new market segments, in particular related to cyber security and software. This is partly due to the changing nature of modern threats. There is a greater risk of a cyber threat than of a conventional conflict (despite growing tensions in Southeast Asia and Eastern Europe).

What part of the initiatives come out of the “Valley of Death”, which is the stage that verifies financially whether they can survive?

In the case of orders for defense ministries, we are talking about the so-called Death Valley, when the product under development is not at a sufficient level of technical readiness (Technology Readiness Level). We distinguish nine levels of technical readiness, from the commencement of basic research to the commercialization stage, i.e. obtaining a technique ready for implementation. Most often, the so-called Death Valley occurs at level 6/7, i.e. testing prototypes in conditions similar to real ones. This situation occurs when, for example, the army expects a technically mature product (TRL7-8), and the entrepreneur or research institute does not have the possibility or willingness to finance further works. It is estimated that only 10% -20% of projects succeed by passing this stage. Why are they successful? Because both the Ministry of Defense and the developer of the solution have the will and readiness to make further investments at such an early stage of development. A role is also played by close cooperation between the creators of innovative solutions, the Ministry of Defense and the end user, i.e. the soldier. The most important, however, is the real demand for the solution being developed – whether by the military or civilian side – and the achievement of clearly defined goals from the very beginning of the project.

Paweł Fleischer (Fleischer Consulting) – “Innovation development ecosystem

in the defense and space sector ”

Marcin Kapuściński – Transition Technologies Managed Services

Read also the first part of the conversation with Paweł Fleischer (New technologies on the battlefield).